Tax & Family Home (Residential Property)

Australians love property and for the property owners among us, it’s an exciting phase in the real estate market of Australia values has risen more than 40% in last 3 years in Sydney and Melbourne market. It’s worth remembering though our beloved tax man could want a share if you sell.

Unless the property is your primary residence, you could find capital gains tax (CGT) taking a cut of your profits.

CGT applies to investment properties, holiday homes and even vacant land.

What is CGT?

CGT is added to your tax bill in the financial year in which you sell an asset. It’s not a separate tax, but is part of normal income tax and is applied at your marginal rate in that particular tax year.

The tax applies to any increase in the value of an asset between the time you buy and sell it. Although most personal assets are exempt from CGT, many property assets are liable.

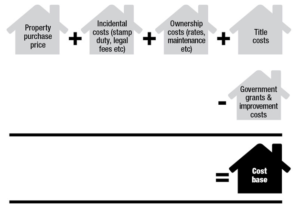

Calculating the cost

If a property is liable for CGT, the capital gain is determined by subtracting its ‘cost base’ from the sale price. The cost base is calculated as follows:

In addition, you must exclude from the cost base the amount of capital works deduction.

If you own the property for over 12 months, you receive a 50 per cent discount on the capital gain.

An important consideration is when the property was purchased, as assets bought before 20 September 1985 are usually exempt from CGT when they are sold.

CGT and the family home

When it comes to your ‘main residence’, CGT is generally not payable providing the home has not been used to produce assessable income (such as running a business or renting it out) and if the land is two hectares or less.

If you live in the residence but then choose to rent it out, you may be required to pay CGT on the periods when you were not the occupant. CGT is also payable if a family home is owned by a company or trust, or if the owner ceases being an Australian resident.

The ATO does not clearly define ‘main residence’, but it bases its assessment on a number of factors. For example, it looks at whether you and your family live in the dwelling and have your personal belongings there, if your mail is delivered there, whether you are registered to vote at the property’s address, or if you have phone, gas and electricity connected.

For your family home to remain exempt from CGT, you can only have one main residence at any time, unless you are in the process of selling your old home and buying a new one.

When this happens you are permitted a six-month period where you can own two homes, but the second property must become your new main residence. You must also have lived in your original home for at least three continuous months in the year before you sell, and it must not have been used to produce assessable income during that period.

If you purchased your home after 20 August 1996, to be entitled to a full exemption you must have lived in the house when it was first bought and not have rented it out prior to moving in. Otherwise, the ATO will consider you bought it purely as an investment to produce income.

The 6-year rule

Even if you do move out of your family home and choose to rent it, you could still be exempt from CGT under the Temporary Absence Rule. Under this rule you can leave for up to six years, rent it out and not be liable for CGT.

If you leave your home but do not rent it out, you can claim a CGT exemption for an indefinite period.

When you buy another property and move in, you can elect to keep your original home as your main residence, but your new dwelling will be subject to CGT.

Inheritance and tax

Generally, CGT does not apply if you inherit a main residence and the property is sold less than two years after the owner dies. In some case, it’s possible to apply to the ATO for an extension to this two-year period.

Take the example of Penny. As an only child, Penny inherited sole ownership of her mother, Shirley’s home when she died.

Shirley had lived in the house with her husband for the entire period since they first bought it in 1950.

Although she loves the home, Penny plans to sell the vacant property as she already owns a house closer to her work. If she sells within two years of Shirley’s death, any profit from the sale will be exempt from CGT. If she fails to sell within two years, Penny could be liable for CGT on the increase in the property’s value from the time of her mother’s death.

CGT is a complex area of taxation law and is dependent on your individual circumstances. If you have any questions about how CGT applies to your family home or assets, please call our office, Accounting Direct to discuss your situation with one of our Accountants – 03 8502 2878.